Condo Insurance in and around Dallas

Townhome owners of Dallas, State Farm has you covered.

State Farm can help you with condo insurance

Your Stuff Needs Insurance—and So Does Your Townhome.

Your condo is your retreat. When you want to rest, laugh and play and relax, that's where you want to be with the ones you love.

Townhome owners of Dallas, State Farm has you covered.

State Farm can help you with condo insurance

Protect Your Home Sweet Home

You want to protect that special place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as hail, theft or vehicles. Agent Josh Shaul can help you figure out how much of this wonderful coverage you need and create a policy that is right for you.

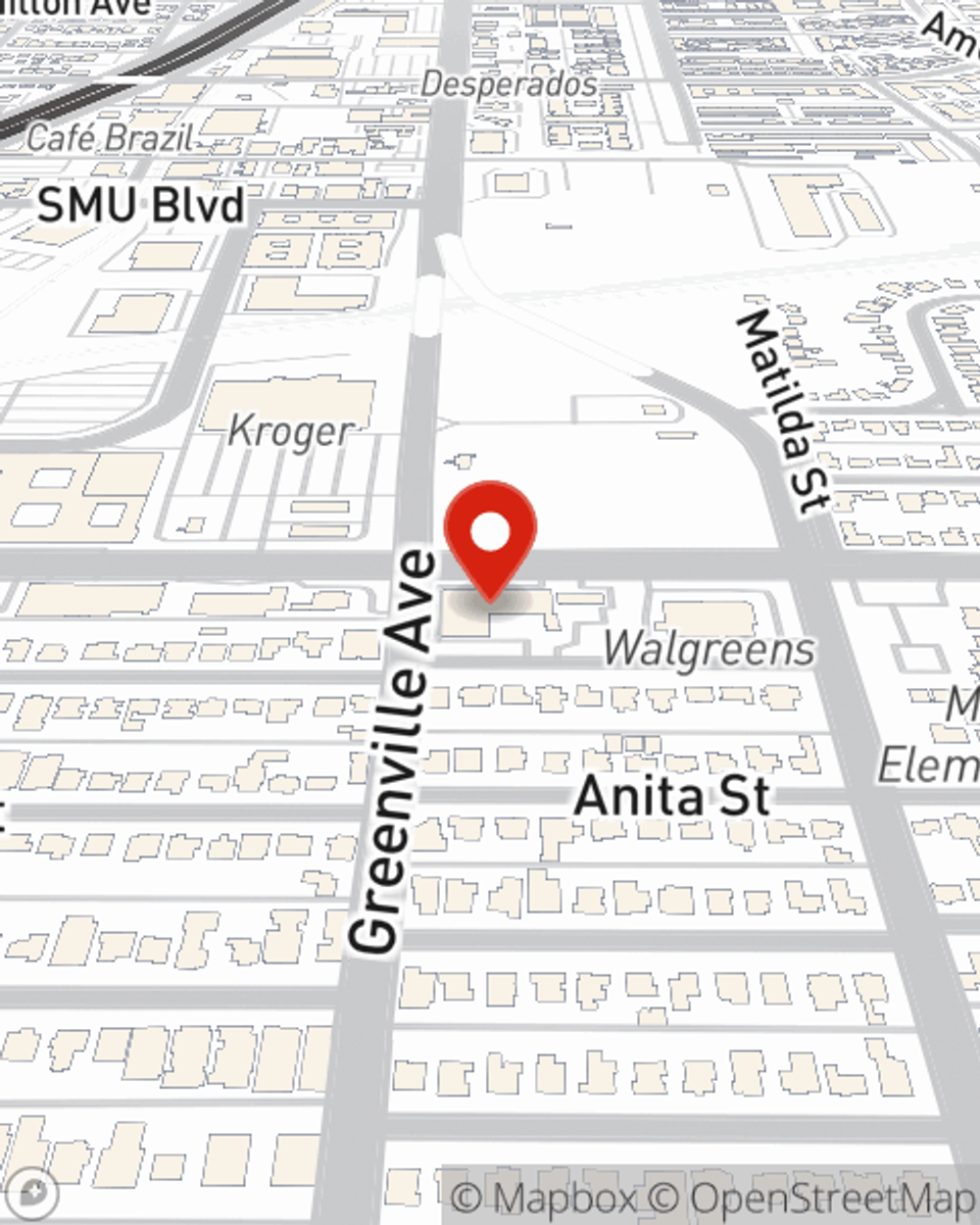

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Visit Josh Shaul's office today to learn more about how you can save with Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Josh at (214) 821-4242 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.